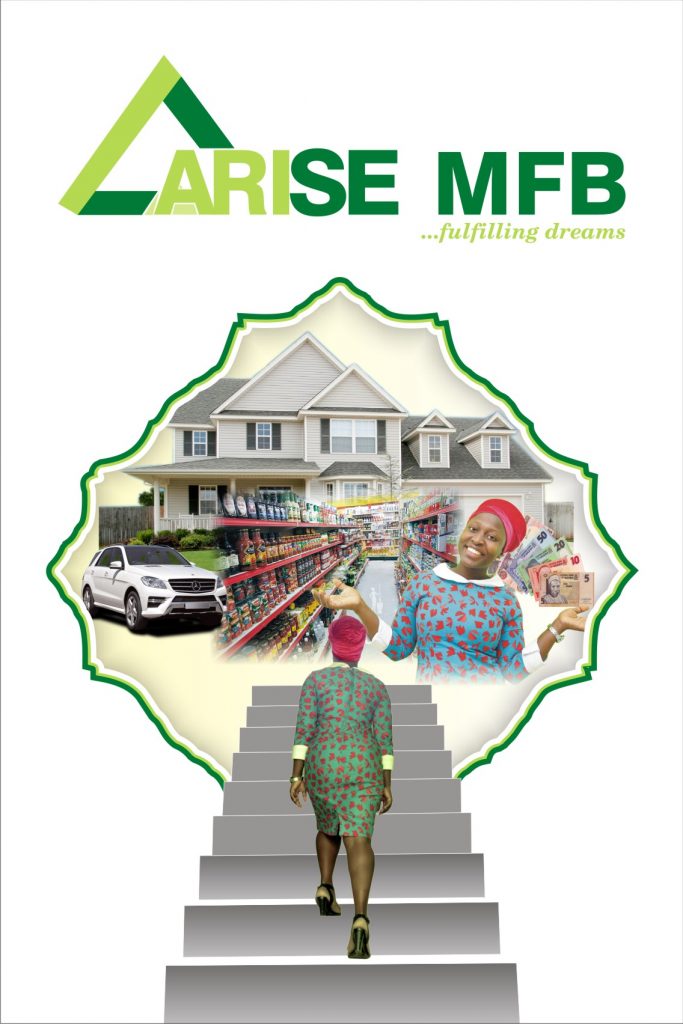

ARISE MF Bank is established to Actively Raise Industrious and Successful Entrepreneurs (ARISE) by providing available, attractive, accessible and affordable financial products and services. The bank is poised to positively impact the critical mass in the informal, formal and public sectors of the Nigerian economy. ARISE MF Bank seeks to operate within the stipulated regulatory framework to support the Apex bank’s goal of financial inclusion thereby providing financial literacy and management to the economically active poor while not neglecting the social impact of an improved standard of living and enabling environment.

A Wide Range of Products You can Choose From

INDIVIDUAL LOANS

- Competitive interest rate | 10% equity contribution(CASH SECURITY)

- 3.5% monthly interest rate | Maximum tenor of Four (4) months

GROUP LOANS

- Competitive interest rate | Group members must be in the same location

- 10% equity contribution(CASH SECURITY) | 3% monthly interest rate

- Maximum tenor of Four (4) months | Group guarantee

- Two credible guarantors. (cross guarantee of loan beneficiaries and an external guarantor each)

FIXED DEPOSIT ACCOUNTS

- Interest is payable at maturity; annually or monthly depending on the term you chose or you could use the money to buy assets if you want.

- You get to choose how long you want to invest your money in a fixed deposit account ranging from 90 days to 365days

- You can choose to have more than one fixed deposit account if you want to save for different goals.

SAVINGS ACCOUNT

Beyond the Generic Savings Account, Other accounts are Joint Savings Account, Target Savings Account, Child Education Savings Account.

CURRENT, CORPORATE & SALARY ACCOUNTS

![IMG-20190618-WA0021[1]](http://arisemfbank.com/wp-content/uploads/2019/06/IMG-20190618-WA00211.jpg)

![IMG-20190619-WA0012[1]](http://arisemfbank.com/wp-content/uploads/2019/06/IMG-20190619-WA00121.jpg)

![IMG-20190624-WA0011[1]](http://arisemfbank.com/wp-content/uploads/2019/06/IMG-20190624-WA00111.jpg)